The satellite data services market is entering a transformative phase, driven by rapid innovation, rising demand for Earth observation, and the growing space economy. From agriculture and defense to disaster management and urban planning, industries are increasingly turning to satellite data for accurate, real-time insights.

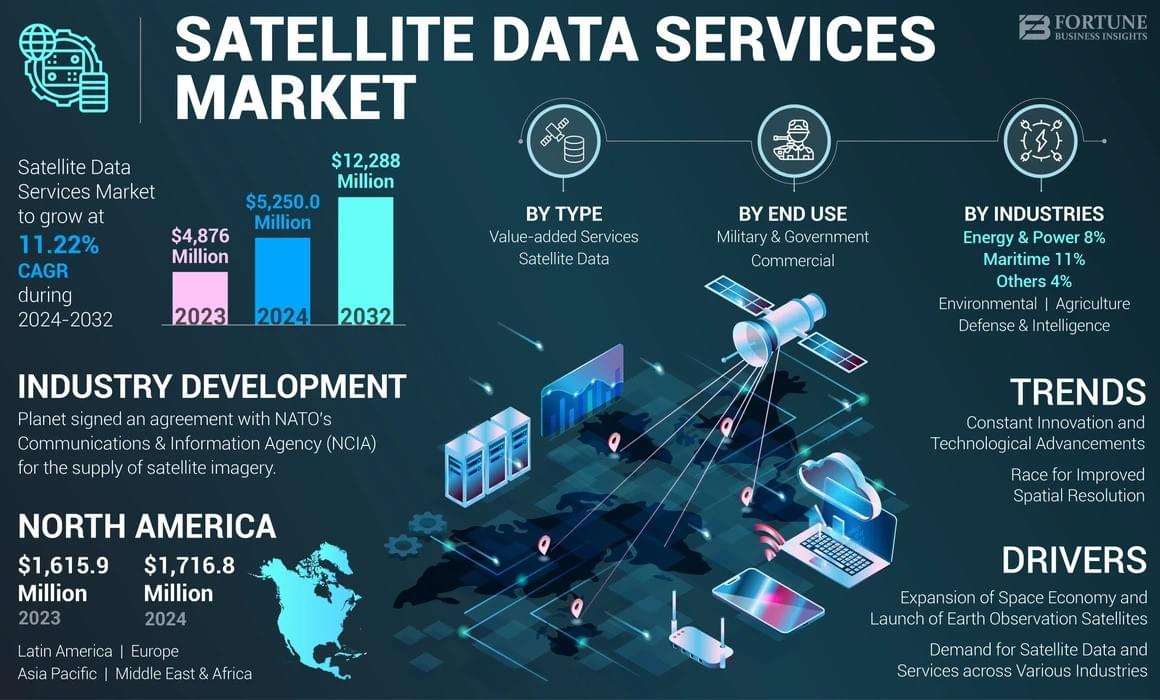

According to Fortune Business Insights™, the global satellite data services market was valued at USD 4.87 billion in 2023, is set to reach USD 5.25 billion in 2024, and is projected to expand to USD 12.29 billion by 2032 at a CAGR of 11.22%. North America led the market in 2023, holding 35.21% share, fueled by strong government programs, NASA’s initiatives, and the presence of key players such as Maxar, Planet Labs, and BlackSky.

What are Satellite Data Services?

Satellite data—often called satellite imagery—refers to information captured by satellites in orbit. The main purpose is Earth Observation (EO), which helps monitor climate change, weather patterns, land use, and urban expansion. Two main methods power this data:

- Passive remote sensing – relying on natural light sources like the Sun.

- Active remote sensing – using radar waves to capture Earth-reflected signals.

Applications are vast, ranging from environmental monitoring, precision farming, and urban planning to defense surveillance and disaster management.

Market Growth Drivers

1. Expansion of the Space Economy

The global space economy is set to hit USD 1.8 trillion by 2035, with Earth observation emerging as a fast-growing segment. Investments in new EO satellites with advanced sensors are fueling demand for higher-resolution and multi-spectral data.

2. Rising Industry Adoption

- Agriculture: Boosting crop yields through precision farming and real-time monitoring.

- Defense: Enhancing surveillance and reconnaissance capabilities, especially amid ongoing geopolitical conflicts like the Russia-Ukraine war.

- Environment: Tracking natural disasters, land use changes, and climate-related risks.

3. Technological Innovations

Companies are rapidly integrating hyperspectral imaging, radar, and RF data into their services. For example, Maxar partnered with Umbra for Synthetic Aperture Radar (SAR) data, while Planet Labs introduced AI-powered analytics to boost spatial resolution up to 10x improvements.

Key Market Trends

- Race for Higher Resolution: New entrants like Albedo and EOI Space aim for ultra-high 10 cm resolution, while established leaders like Maxar and Airbus target 15–25 cm imagery.

- AI & Data Analytics: AI-driven platforms are transforming raw imagery into actionable insights. Planet Labs’ Planet Insights Platform combines EO datasets with analytics for faster decision-making.

- Government-Private Partnerships: Programs like NASA’s Commercial Smallsat Data Acquisition (CSDA) and NATO’s APSS highlight the growing role of private players in global security and monitoring efforts.

Information Source:

https://www.fortunebusinessinsights.com/satellite-data-services-market-108359

Regional Insights

- North America: Largest market (USD 1.72 billion in 2023) supported by NASA, DoD, and private sector innovation.

- Europe: Strong collaborations under ESA and sustainability projects like the European Green Deal.

- Asia Pacific: Fastest-growing, led by China and India investing in EO satellites for disaster response, agriculture, and security.

- Latin America & Middle East/Africa: Growing adoption in environmental and maritime monitoring.

Key Industry Players

Leading companies are focusing on M&A, partnerships, and new product launches to stay ahead:

- ICEYE (U.K.) – SAR data solutions.

- Planet Labs (U.S.) – high-resolution optical imaging and analytics.

- Capella Space (U.S.) – SAR-based monitoring.

- Maxar Technologies (U.S.) – EO intelligence solutions.

- Airbus (Netherlands) – advanced commercial satellite imagery.

- BlackSky (U.S.) – AI-powered geospatial intelligence.

- Spire Global, EOS Data Analytics, L3Harris Technologies among others.

Challenges Facing the Market

- High Capital Investment: Building and launching satellites involves millions in costs, creating entry barriers for startups.

- Data Management Complexity: With more satellites generating vast datasets, managing and analyzing information at scale is a growing challenge.

- Geopolitical Tensions: While conflicts drive demand for surveillance data, regulatory restrictions may impact global market collaboration.

Outlook and Future Opportunities

The satellite data services market is set for robust expansion with the convergence of AI, big data analytics, and next-gen satellites. With governments, defense agencies, and commercial industries relying more heavily on EO, the market will see deeper penetration into agriculture, climate monitoring, and disaster response.

The trend toward high-resolution, multi-sensor intelligence solutions positions satellite data services as a critical enabler of global decision-making in the coming decade.

KEY INDUSTRY DEVELOPMENTS

In September 2024, ICEYE secured a five-year contract with NASA under its Commercial Smallsat Data Acquisition (CSDA) Program. The indefinite-delivery/indefinite-quantity (IDIQ) agreement enables ICEYE to supply Synthetic Aperture Radar (SAR) data, which will support NASA’s Earth Science Division in advancing scientific research, analysis, and application objectives.

No responses yet