According to Fortune Business Insights™, the global push-to-talk market was valued at USD 12.00 billion in 2019 and is projected to grow to USD 46.75 billion by 2032, exhibiting a CAGR of 12.0% during the forecast period. North America accounted for the largest share of 37.42% in 2019, supported by early adoption of advanced communication technologies and the strong presence of leading telecom and technology players.

Market Growth Overview

The growth of the push-to-talk market is being driven by the rising adoption of cloud-based Push-to-Talk over Cellular (PoC) solutions among enterprises. These systems provide real-time, secure, and scalable communication platforms with advanced features such as multimedia sharing, GPS location tracking, and two-way voice services.

Large enterprises are adopting PoC for portable, cost-efficient communication, enhanced call management, and improved safety, particularly across industries like public safety, logistics, utilities, and construction.

Technological advancements in LTE and 5G infrastructure are also fueling market expansion. High-speed, low-latency networks enable mission-critical PTT applications. Fortune Business Insights™ notes that the global 5G infrastructure market, valued at USD 720.6 million in 2018, is projected to reach USD 50,640.4 million by 2026 at a remarkable CAGR of 76.29%, significantly enhancing PTT system capabilities across public safety and enterprise domains.

Emerging technologies such as IoT, AI, natural language processing (NLP), and mobile applications are expected to unlock new opportunities. Furthermore, industry players are pursuing mergers, acquisitions, and partnerships to strengthen market presence. For example, in March 2019, Motorola Solutions acquired Avtec, Inc., a U.S.-based VoIP dispatch communications provider, to expand its end-to-end PTT platform for public safety.

Growth Drivers

The growth of the push-to-talk market is strongly supported by several key factors. One of the most significant drivers is the rising adoption of wireless PTT devices across industries such as defense, enterprise, and commercial sectors, which is enhancing both productivity and operational safety. Another major factor is the increasing demand for PTT software, with smartphone-based applications enabling seamless group communication and thereby boosting overall market penetration. Additionally, the expansion of accessories and network devices, including wireless microphones, speakers, and rugged PTT-enabled devices with advanced multimedia storage, is contributing to market expansion. Furthermore, rapid advances in communication networks such as LTE and 5G are enabling the deployment of mission-critical PTT solutions with greater speed, scalability, and reliability, creating new growth opportunities.

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/push-to-talk-market-100079

Restraining Factors

Despite its promising outlook, the push-to-talk market faces a few challenges that could hinder its growth. One of the primary restraints is latency in communication, particularly for users in areas with weak or limited network coverage, where LMR-based systems often experience delays. Another barrier is the high infrastructure cost associated with deploying PTT systems, which poses a challenge for small and medium-sized enterprises with limited budgets. Additionally, the market continues to struggle with lack of awareness and infrastructure gaps, particularly in emerging economies where adoption of PTT solutions is slower due to insufficient technological readiness. These factors collectively act as bottlenecks to widespread adoption, though advancements in next-generation communication technologies are expected to gradually mitigate these issues.

Segmentation Overview

By Component

- Devices (largest share): Rugged, innovative PTT devices with enhanced displays, multimedia, and longer battery life drive adoption.

- Software & Services: Software innovation is improving workflow efficiency. For instance, in 2020 Honeywell launched Smart Talk software enabling VoIP, messaging, and collaboration for mobile workers.

By Network Type

- Land Mobile Radio (LMR): Strong adoption in defense, law enforcement, and public safety.

- Push-to-Talk over Cellular (PoC): Expected to register the fastest CAGR due to cost-efficiency, broad coverage, and high-quality audio. In 2019, Hytera launched PNC370 PoC radio, strengthening flexible dispatching and wide-area communication.

By Enterprise Size

- Large Enterprises (leading share): Adopt cloud-based PTT to bridge communication gaps across dispersed operations.

- SMEs: Favor cost-effective PoC solutions for real-time secure communication without high infrastructure investments.

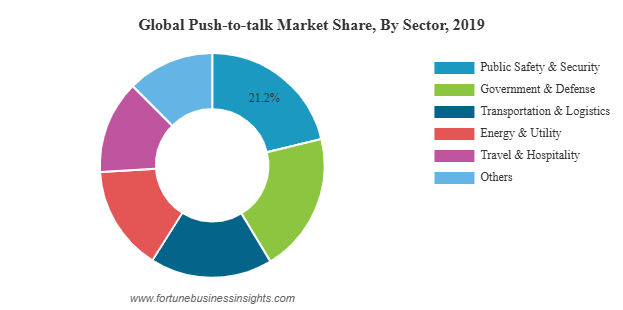

By Sector

- Public Safety & Security (largest share, 21.2% in 2019): Adoption of ultra-rugged devices and mission-critical communication solutions. In 2020, AT&T launched MCPTT-based FirstNet solutions for public safety.

- Government & Defense: Adoption supported by growing border security concerns.

- Transportation & Logistics, Energy & Utility, Travel & Hospitality: Rising demand for cost-effective, cloud-based communication solutions.

Market Trends

- Shift from LMR to LTE-based solutions: Enterprises are migrating to LTE platforms for broader coverage and scalability.

- Device innovation: Companies such as Kyocera and Motorola Solutions are introducing ruggedized LTE/5G-enabled PTT devices for harsh environments.

- Strategic collaborations: Firms like Siyata Mobile, Verizon, and AT&T are collaborating to launch next-gen MCPTT solutions for enterprises and public safety agencies.

Regional Insights

- North America (leading share): Growth driven by presence of key players (Motorola Solutions, AT&T), advanced telecom infrastructure, and public safety investments.

- Asia-Pacific (fastest-growing region): Strong adoption in China and India due to public safety investments and IT infrastructure development. Example: In 2018, Kyocera launched ultra-rugged DuraForce PRO 2 smartphone with Verizon Wireless.

- Europe: Presence of key providers such as iPTT and Azetti Networks, with steady adoption in hospitality, transportation, and construction sectors.

- Middle East & Africa & Latin America: Growth supported by IoT, cloud, and AI adoption, alongside rising public safety needs in Brazil and Mexico.

Key Industry Players

Major companies in the push-to-talk market include:

- Motorola Solutions Inc. (US)

- Zebra Technologies Corporation (US)

- AT&T Intellectual Property (US)

- Verizon Wireless (US)

- Qualcomm Technologies, Inc. (US)

- Harris Corporation (US)

- ICOM Inc. (Japan)

- Kyocera

- Siyata Mobile (Canada)

- ECOM Instruments GmbH (US)

- RugGear (US)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Sonim Technologies (US)

- Simoco (India)

- Airbus DS Communications (US)

Recent Industry Developments

- March 2020 – Ericsson acquired Genaker, a Spain-based MCPTT solutions provider, strengthening its mission-critical communication offerings.

- March 2019 – Motorola Solutions acquired Avtec, Inc., enhancing its software portfolio and expanding PTT solutions for public safety customers.

No responses yet