The global handgun market was valued at USD 3.12 billion in 2022 and is projected to grow from USD 3.41 billion in 2023 to USD 5.35 billion by 2030, at a CAGR of 6.6% during the forecast period. North America held the dominant share of 43.27% in 2022, supported by high civilian firearm ownership, strong defense procurement programs, and the presence of key manufacturers such as SIG SAUER, Smith & Wesson, and Glock GmbH.

Handguns, defined as compact firearms designed to be fired with one hand, are widely used for self-defense, law enforcement, sports shooting, hunting, and defense applications. The two most common types are revolvers and semi-automatic pistols, while single-shot handguns and machine pistols remain less prevalent.

Russia–Ukraine War Impact

The Russia–Ukraine war has significantly accelerated market growth, particularly in Europe, where firearm procurement and defense modernization programs have intensified. NATO members have increased firearm acquisitions for border security and combat readiness. Notably, the EU’s historic decision to procure and supply weapons to Ukraine has further boosted global demand.

According to SIPRI, the U.S. accounted for 40% of global arms exports between 2018–2022, compared with 33% during 2013–2017. Meanwhile, European arms imports surged by 47% over the same period. In May 2022, the U.S. Department of Defense awarded USD 136.8 million in contracts for weapons and equipment in support of Ukraine.

Key Market Highlights

- 2022 Market Size: USD 3.12 billion

- 2023 Market Size: USD 3.41 billion

- 2030 Forecast Size: USD 5.35 billion

- CAGR (2023–2030): 6.6%

- Regional Leader (2022): North America (43.27% share)

By type, semi-automatic pistols are expected to maintain the largest share due to their popularity in law enforcement, security, and sports.

Market Trends

Development of Polymer-based Handguns

The rise of polymer-frame handguns is one of the most notable trends. Lighter than traditional metal weapons, polymer models offer durability, corrosion resistance, and easier maneuverability. Leading examples include the Glock-19, Smith & Wesson M&P Shield, Sig Sauer P320, and HK VP9.

For instance, in January 2020, the U.S. Marine Corps awarded a USD 10 million contract to MAC LLC for lightweight polymer-based ammunition, highlighting the military’s shift toward weight-reduction technologies.

Growth Drivers

- Technological Advancements in Firearms

- Development of high-tech weapons such as automatic and sub-machine guns.

- U.S. arms makers like Textron Systems, General Dynamics, and SIG SAUER are innovating advanced 6.8 mm firearms to replace traditional 5.56 mm NATO rifles.

- Civilian Demand

- Rising interest in personal protection, hunting, and sports shooting is fueling growth.

- Over 1 billion firearms are owned globally, with 85% held by civilians (2017 survey).

- Gun purchases surged in the U.S. during the COVID-19 pandemic due to heightened safety concerns.

Restraining Factors

- Stringent Regulations: Political, legal, and economic restrictions on firearms sales and imports affect market growth.

- Compliance Challenges: Companies face barriers such as export controls, anti-corruption laws, and technology transfer regulations that vary by country.

Information Source:

https://www.fortunebusinessinsights.com/handgun-market-108876

Segmentation Insights

By Type

- Single-Shot Handguns (Muzzleloaders)

- Revolvers

- Semi-Automatic Pistols (largest and fastest-growing segment)

By Operation

- Automatic (dominant segment, driven by defense procurement)

- Semi-Automatic

- Manual

By End-user

- Defense & Homeland Security (largest share in 2022)

- Self-Defense

- Sports

- Hunting

- Law Enforcement

Regional Outlook

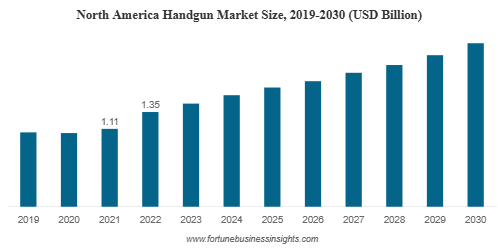

- North America: Largest market (USD 1.35 billion in 2022) driven by defense budgets, civilian firearm ownership, and military modernization.

- Europe: Second-largest market; growth accelerated by the Russia–Ukraine conflict and rising NATO procurement.

- Asia Pacific: Strong growth expected from India, China, South Korea, and Australia, supported by modernization programs and cross-border tensions.

- Middle East & Africa / Latin America: Moderate but rising demand due to increased defense spending and international collaborations.

For example, in July 2023, Brazil’s Taurus signed a deal with Saudi Arabia to supply military and police firearms.

Competitive Landscape

The market is moderately consolidated, with leading players focusing on innovation, partnerships, and defense contracts. Lack of stringent entry barriers is expected to encourage new domestic entrants.

Key Players:

- Glock GmbH (Austria)

- SIG SAUER (U.S.)

- Sturm, Ruger & Co., Inc. (U.S.)

- FN Herstal (Belgium)

- Beretta (Italy)

- Smith & Wesson (U.S.)

- Ceska zbrojovka a.s. (Czech Republic)

- Colt’s Manufacturing (U.S.)

- Israel Weapon Industries (Israel)

- Kalashnikov Group (Russia)

Key Industry Developments

- Aug 2023: AWEIL (India) launched Prabal, a long-range revolver with 50m firing reach.

- Oct 2022: Jindal Defense and Taurus Armas announced a joint venture to manufacture small arms in India.

No responses yet