According to Fortune Business Insights™, the global Aircraft Health Monitoring System (AHMS) market was valued at USD 4.20 billion in 2019 and is projected to reach USD 20.58 billion by 2032, growing at a strong CAGR of 13.0% during the forecast period.

Although the market experienced a sharp setback in 2020 with a -44.8% decline due to COVID-19 and aviation shutdowns, recovery has been robust. Increasing demand for next-generation aircraft, predictive maintenance, and passenger safety measures are fueling long-term growth.

Market Segmentation Insights

By sub-system, aero-propulsion systems account for the largest share of the market, primarily because engine monitoring is essential to ensuring flight safety, operational efficiency, and compliance with stringent aviation standards. These systems allow real-time health assessment of engines, helping operators detect anomalies early, reduce in-flight risks, and improve overall fleet availability. The high cost of engines and their central role in aircraft performance further make this segment the cornerstone of health monitoring solutions. In addition, other sub-systems such as airframes, ancillary systems, software, and related components contribute significantly to fleet reliability. These systems provide valuable data on structural integrity, hydraulic performance, avionics, and digital control, collectively enhancing operational safety and lowering long-term maintenance costs.

By technology, prognostic systems lead the market due to their predictive capabilities, which allow airlines and operators to foresee potential component failures well in advance. This enables planned interventions, reduces unexpected downtime, and optimizes maintenance schedules, making them particularly attractive in commercial aviation where fleet utilization is a key profitability driver. In parallel, diagnostic systems, detection systems, adaptive controls, and other supporting technologies continue to play a vital role by providing fault identification, continuous condition monitoring, and corrective responses to real-time anomalies. The combination of prognostic and diagnostic tools offers a comprehensive solution that improves reliability while reducing total lifecycle costs.

By platform, commercial aircraft dominate the AHMS market, driven by rapid global air traffic growth and fleet expansion initiatives by leading airlines. The integration of advanced health monitoring solutions in next-generation aircraft such as the Boeing 787, Airbus A320neo, and A350 reflects this trend, as carriers seek greater operational efficiency and reduced maintenance overhead. Business jets are also embracing these systems, as operators prioritize efficiency, safety, and passenger confidence in high-value private aviation. Regional aircraft are experiencing rising adoption, particularly in emerging economies, where short-haul connectivity is expanding rapidly. Meanwhile, the military aircraft segment contributes steadily, as defense agencies invest in AHMS to extend fleet lifespans, maintain combat readiness, and minimize risks associated with mission-critical operations.

By fit, line-fit installations dominate the market, as most new aircraft are designed with integrated health monitoring systems during production. OEMs are increasingly embedding these solutions into aircraft to comply with modern safety standards and to meet growing customer demand for digitalization and predictive maintenance capabilities. However, the retrofit segment is witnessing the fastest growth and is projected to surpass USD 2.76 billion by 2025, driven by the need to modernize and extend the life of aging fleets worldwide. Airlines operating older aircraft are increasingly investing in retrofit AHMS solutions to enhance safety, reduce operational disruptions, and comply with regulatory requirements, making this segment a key driver of future market expansion.

Regional Insights

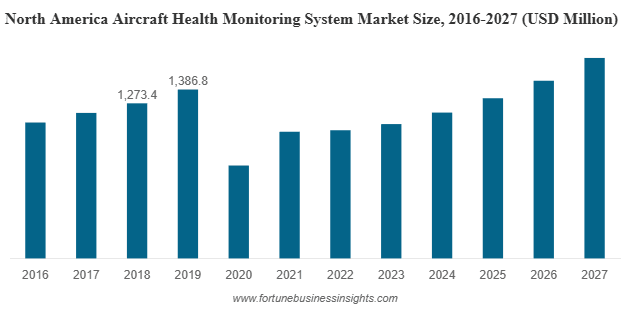

- North America: Leading region with USD 1.38 billion in 2019, supported by key players like Boeing, Honeywell, and United Technologies, alongside strong regulatory mandates.

- Europe: Expected to see steady growth due to predictive maintenance adoption and stringent aviation safety regulations.

- Asia Pacific: Poised for the highest CAGR, fueled by rising passenger traffic, growing fleet sizes in China and India, and increased investments in aviation infrastructure.

- Rest of the World: Growth supported by expanding fleets in the Middle East, Latin America, and Africa.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-health-monitoring-system-market-105027

Growth Drivers

One of the primary drivers of the Aircraft Health Monitoring System (AHMS) market is the rising demand for next-generation aircraft. Modern aircraft such as the Boeing 787, 777X, Airbus A320neo, and A350 are increasingly being equipped with advanced AHMS solutions. These systems are no longer optional but have become essential for boosting operational efficiency, ensuring compliance with stringent safety standards, and reducing maintenance-related disruptions. The integration of AHMS into new aircraft platforms reflects the industry’s shift toward smarter, data-driven operations.

Another significant factor fueling growth is the focus on predictive maintenance and passenger safety. Predictive maintenance capabilities allow operators to anticipate component failures before they occur, thereby reducing unplanned downtime, lowering maintenance costs, and improving fleet utilization. At the same time, regulatory mandates around passenger safety are driving airlines to adopt real-time monitoring systems that support data-driven decision-making. Together, these developments enhance both operational reliability and customer confidence.

Technological advancements, particularly the adoption of the Internet of Things (IoT) and the shift toward More Electric Aircraft (MEA), are also transforming the AHMS landscape. IoT integration enables seamless, real-time data sharing across operators, maintenance teams, and manufacturers, strengthening predictive capabilities and improving system reliability. Meanwhile, the aviation industry’s move toward MEA platforms—where traditional hydraulic and mechanical systems are replaced with electric ones—creates new demand for advanced monitoring solutions. Electric systems, being highly sensitive and mission-critical, require continuous monitoring to ensure serviceability and cost efficiency, thereby driving further adoption of AHMS solutions.

Restraining Factor

- Lack of Common Industry Standards: Fragmented database management and varying component standards limit interoperability, hindering widespread adoption of AHMS solutions.

Competitive Landscape

The AHMS market is highly consolidated, with strong barriers to entry due to certification requirements and large-scale data management needs.

Key Players:

- Airbus S.A.S. (Netherlands)

- Boeing (US)

- United Technologies Corporation (US)

- Honeywell International, Inc. (US)

- General Electric (US)

- Rolls Royce (UK)

- SAFRAN (France)

- FLYHT (Canada)

- Curtiss-Wright (US)

- Tech Mahindra (India)

- Meggitt (UK)

- Lufthansa Technik (Germany)

Recent Industry Developments

- In July 2021, GE Digital announced a strategic alliance with Airbus and Delta TechOps to advance fleet health monitoring and diagnostics solutions. Through this collaboration, the three aviation leaders are combining their expertise in digital analytics, aircraft systems, and airline maintenance operations. The partnership is designed to deliver significant cost savings and enhance network efficiencies, benefiting more than 140 commercial aviation operators worldwide.

No responses yet