According to Fortune Business Insights™, the global aircraft fairings market was valued at USD 1.41 billion in 2020 and is expected to grow from USD 1.46 billion in 2021 to USD 2.60 billion by 2028, registering a strong CAGR of 8.59%. This growth is powered by the aviation industry’s push for lightweight, aerodynamic components that boost fuel efficiency, reduce drag, and improve performance and aesthetics.

Why Aircraft Fairings Matter

Aircraft fairings are more than just covers—they are critical aerodynamic structures that smooth out gaps and joints in an aircraft’s body. By reducing drag and delaying boundary layer separation, fairings improve fuel efficiency and overall performance, while also enhancing the aircraft’s visual appeal.

A classic example is the flap track fairing, a pod-like structure under an aircraft’s wing. While Airbus and Boeing use similar fairings, McDonnell Douglas aircraft stand out with vertical fairings housing hydraulic actuators. Fairings are typically built from aluminum or composites, with composites increasingly favored for their lightweight, high-strength properties.

As air travel demand rises and airlines modernize fleets, the need for advanced, efficient fairing systems will continue to grow.

Market Dynamics

Growth Drivers

- Rising Demand for Composite Aerostructures

Modern aircraft prioritize strength-to-weight optimization, making composite aerostructures—fairings, doors, control surfaces—essential for efficiency. The growing adoption of composites is a key driver of this market. - Procurement of Lightweight Aircraft

Airlines and defense forces are increasingly acquiring fuel-efficient, lightweight aircraft. The expansion of low-cost carriers (LCCs) and the procurement of trainer and multi-role fighter jets are accelerating fairing demand.

Restraining Factor

Backlogs in Aircraft Orders

Aircraft manufacturers continue to face order backlogs and delivery delays. COVID-19 further amplified this challenge, with aircraft deliveries dropping 42% in 2020 compared to 2019. Such bottlenecks slow down the adoption of new components like fairings.

Key Trends Shaping the Market

3D Printing in Aerospace

Additive manufacturing is revolutionizing aerospace supply chains by enabling on-demand production of complex parts.

- In November 2021, Materialise partnered with Proponent to expand 3D printing in aerospace aftermarket supply chains. Proponent already supplies 54 million parts annually to 6,000 clients, and with 3D printing, the company aims to further improve aftermarket support.

From MRO services to Urban Air Mobility, 3D printing is driving the next phase of efficiency and innovation in aircraft component manufacturing.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-fairings-market-105857

Segmentation Insights

By Platform

- Commercial Aircraft: Largest segment in 2020, supported by global air traffic growth and fleet modernization.

- Military Aircraft: Expected to grow fastest, driven by rising defense budgets and procurement of multi-role combat and transport aircraft.

- Regional & General Aviation: Steady contribution from private and business jet adoption.

By Application

- Fuselage: Largest segment, backed by advances in lightweight and durable structural designs.

- Landing Gear: Fastest-growing, with demand for lighter yet stronger systems.

- Engines, Control Surfaces, Radars & Antennas: Continue steady adoption with performance-oriented designs.

By Material

- Composites: Leading segment, favored for lightweight and fuel-saving properties.

- Aluminum: Gradually declining due to higher maintenance costs.

- Alloys: Maintain a niche role in specialized applications.

Regional Outlook

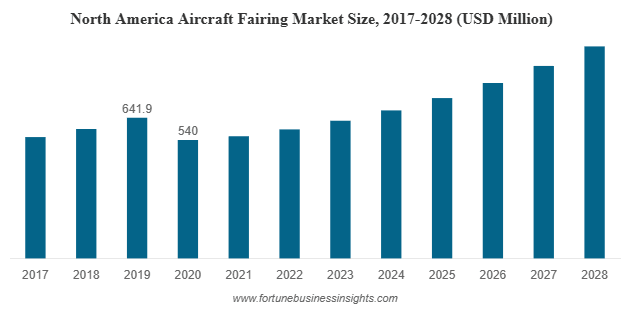

- North America: Valued at USD 540 million in 2020, remains the leader due to OEMs like Boeing and operators like Delta, FedEx, UPS.

- Europe: Moderate growth with major players including Airbus, Saab AB, Leonardo Spa.

- Asia Pacific: Fastest-growing, driven by rising passenger traffic in China, India, and Japan. India’s aviation boom is a standout driver.

- Middle East & Africa: Growth supported by tourism and general aviation, with Strata Manufacturing (UAE) boosting regional production.

Competitive Landscape

The aircraft fairings market is moderately consolidated, with top players focusing on lightweight, fuel-efficient designs. Companies are investing in capacity expansion, partnerships, and composite innovations.

Key Players

- Airbus (France)

- Boeing (U.S.)

- Strata Manufacturing (UAE)

- SAAB AB (Sweden)

- Lockheed Martin (U.S.)

- FACC AG (Austria)

- Daher (France)

- Avcorp (Canada)

- Barnes Group (U.S.)

- Royal Engineered Composites (U.S.)

Recent Developments

- Dec 2021 – Airbus completed structural assembly of its first A321XLR test aircraft, including door fairings.

- Feb 2021 – Boeing expanded its Tata Boeing Aerospace Limited (India) line to produce 737 MAX vertical fins.

No responses yet