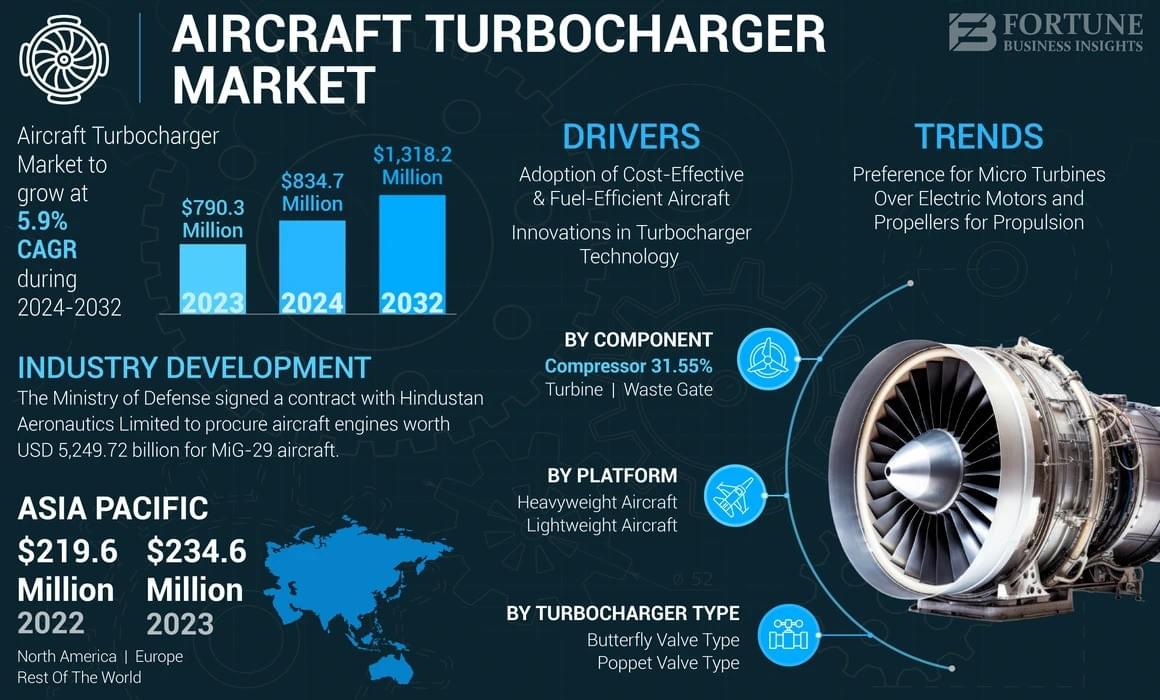

The aircraft turbocharger market is witnessing strong growth as the aviation industry prioritizes fuel efficiency, performance, and sustainable operations. Valued at USD 790.3 million in 2023, the market is expected to expand from USD 834.7 million in 2024 to USD 1,318.2 million by 2032, reflecting a healthy CAGR of 5.9% over the forecast period.

Asia Pacific led the global market in 2023 with a 29.68% share, driven by booming civil aviation, military modernization, and investments in advanced aircraft propulsion systems.

What is an Aircraft Turbocharger?

An aircraft turbocharger is a forced induction device that harnesses exhaust gas energy to compress intake air, ensuring more oxygen enters the combustion chamber. This process boosts engine performance, particularly at high altitudes, where reduced air density often hampers efficiency. Turbochargers allow piston engines to maintain near sea-level performance up to a critical altitude, making them indispensable in modern aviation.

Key Market Highlights

- 2023 Market Size: USD 790.3 million

- 2024 Estimate: USD 834.7 million

- 2032 Projection: USD 1,318.2 million

- CAGR (2024–2032): 5.9%

- Leading Region: Asia Pacific (29.68% share in 2023)

Market Trends

Shift Towards Micro Turbines

Growing interest in micro turbines over electric motors and propellers is reshaping aviation propulsion. Unlike electric systems that face battery limitations, micro turbines deliver higher power, quicker refueling, and extended endurance. For example, FusionFlight’s AB6 JetQuad, powered by four micro-turbines, represents the next step in drone propulsion for emergency and monitoring applications.

Technological Advancements in Turbochargers

Innovations such as intercooled turbochargers and electric turbochargers (E-Turbos) are improving thrust, responsiveness, and fuel efficiency. E-Turbos, powered by electric motors, address turbo lag and can cut NOx emissions by up to 20%, making them essential in meeting stringent environmental regulations.

Growth Drivers

- Rising demand for cost- and fuel-efficient aircraft across commercial and defense aviation.

- Fleet modernization programs in Asia Pacific, North America, and Europe.

- Increasing defense budgets fueling demand for high-performance propulsion systems.

- Sustainability initiatives pushing airlines to adopt cleaner and efficient technologies.

Restraints

- Long engine lifespans reduce the frequency of turbocharger replacements.

- Aircraft production backlogs continue to delay new deliveries, slowing market expansion.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-turbocharger-market-111198

Segmentation Overview

By Platform

- Heavyweight Aircraft: Largest share, fueled by demand for high-efficiency engines in commercial and defense aviation.

- Lightweight Aircraft: Growing adoption in general aviation and UAVs.

By Turbocharger Type

- Butterfly Valve Type: Leading and fastest-growing segment, favored for its reliability, low maintenance, and cost-effectiveness.

- Poppet Valve Type: Rising demand driven by eco-friendly and efficient technologies.

By Component

- Turbine: Dominant segment due to rapid innovations and adoption in both commercial and defense aircraft.

- Compressor & Waste Gate: Significant growth supported by expanding aviation traffic and engine modernization.

Regional Insights

- Asia Pacific: Largest market, led by China and India, driven by rapid aviation growth and military modernization.

- North America: Strong growth expected with technological advancements and presence of industry leaders like Honeywell and GE Aviation.

- Europe: Demand fueled by strict emission norms and adoption of next-gen turbochargers.

- Middle East & Latin America: Moderate growth from fleet modernization and aviation development projects.

Key Players

Prominent companies shaping the aircraft turbocharger market include:

- Honeywell International Inc. (U.S.)

- General Electric Company (U.S.)

- BorgWarner Inc. (U.S.)

- Hartzell Engine Technologies LLC (U.S.)

- ABB Ltd. (Switzerland)

- Kawasaki Heavy Industries Ltd. (Japan)

- PBS Group A.S. (Czech Republic)

- Rajay Parts LLC (U.S.)

- Victor Aviation Service Inc. (U.S.)

- Airmark Overhaul Inc. (U.S.)

These players focus on advanced designs, hybrid propulsion integration, and long-term partnerships with airlines and defense organizations.

Recent Developments

- March 2024: Indian Ministry of Defense signed a major contract with Hindustan Aeronautics Limited (HAL) for MiG-29 engine procurement and localization.

- January 2024: Rolls-Royce entered a 7-year agreement with Azad Engineering (India) to manufacture military engine components.

No responses yet